This article aims to explore in-depth Understanding AI’s Limitations in Bear vs. Bull Markets, guiding beginner and seasoned investors alike on how to interpret AI-driven insights wisely, particularly during extreme market conditions.

Artificial Intelligence (AI) has revolutionized financial forecasting, stock trading, and investment decisions. But despite its growing influence, AI isn’t flawless—especially when facing the volatile and often emotional nature of stock market cycles.

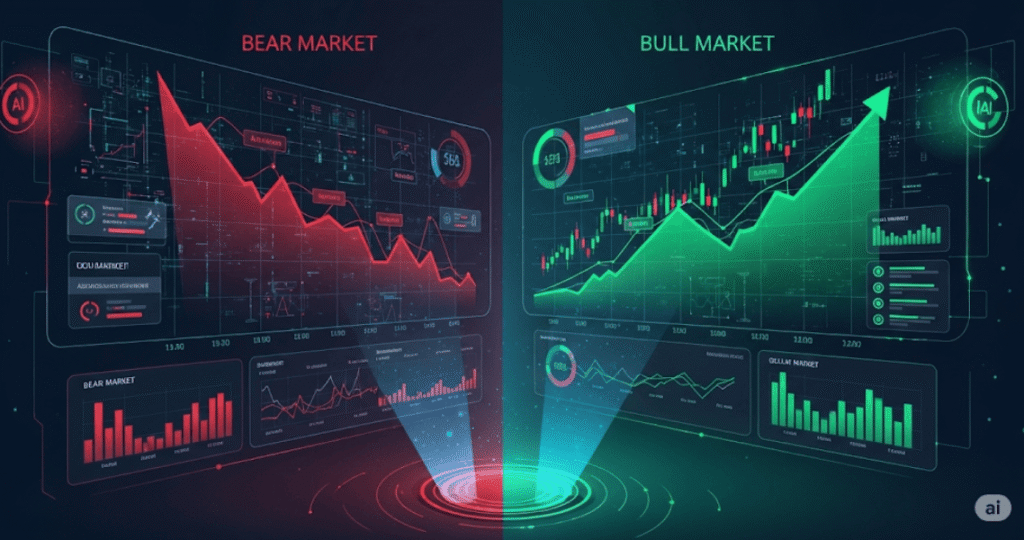

📈 What Are Bull and Bear Markets?

Before exploring AI’s limitations, it’s essential to understand the market environments in question:

Bull Market: A period where stock prices rise consistently. Driven by investor confidence, strong economic indicators, and favorable news cycles.

Bear Market: Characterized by falling stock prices (typically 20% or more), investor pessimism, and economic downturns.

AI models behave differently in each scenario due to data dependencies, biases, and prediction methods.

🔍 How AI Analyzes Market Trends

AI uses vast datasets and historical patterns to:

Detect technical indicators (RSI, MACD, etc.)

Analyze news and sentiment

Forecast short- and mid-term trends

Generate buy/sell signals

Machine learning models like LSTMs, decision trees, and neural networks identify trends based on the assumption that past behavior predicts future outcomes. This assumption becomes a limitation during high volatility.

⚠️ Limitations of AI in Bear Markets

1. Overfitting to Bullish Data Bias

Many AI models are trained during bull markets, where the majority of data shows upward trends. This creates a bullish bias in predictive outputs.

🧠 AI Limitation: During a bear market, these models may continue issuing optimistic signals or underreact to downward momentum.

2. Failure to Predict Panic-Driven Sell-offs

Bear markets are often triggered by emotional reactions: fear, panic, geopolitical shocks, or unexpected economic events.

📉 AI Limitation: Models trained on structured financial data struggle to quantify irrational investor behavior.

3. Sentiment Analysis Misfires

NLP-driven AI may misinterpret sarcastic or ironic headlines, especially during times of mass fear or public anger.

📰 AI Limitation: Can’t always differentiate market sarcasm from legitimate sentiment shifts in media.

4. Poor Performance in Low Liquidity Conditions

Bear markets usually result in lower trade volumes and high bid-ask spreads.

📊 AI Limitation: Algorithms based on normal liquidity may misjudge volatility or fail to execute simulated strategies effectively.

5. Short-Term Overreactions

AI often reacts to real-time data, which may include false signals or temporary price dips.

⚡ AI Limitation: Without human judgment, AI might exaggerate or misinterpret small movements as large-scale trends.

🌞 AI in Bull Markets: Still Not Perfect

Even in favorable conditions, AI has limitations that traders must understand.

1. Chasing Momentum Blindly

In bull markets, momentum indicators remain positive longer. AI might overcommit to rallying stocks, failing to predict eventual corrections.

🚀 AI Limitation: Lack of skepticism or contrarian analysis.

2. Underestimating Valuation Risk

AI relies heavily on price movement and may overlook overvaluation or poor fundamentals in high-growth sectors.

📈 AI Limitation: Can favor speculative assets if they show bullish technical indicators.

3. Bias Toward Trend Continuation

Bull markets foster “buy the dip” psychology, which some models replicate excessively.

🌀 AI Limitation: Might keep suggesting buys even as macroeconomic indicators turn negative.

🧠 The Root of These Limitations: Data Dependency

AI models are as good as the data they are fed.

Historical bias: AI can only learn from the past

Imbalanced datasets: More bull data than bear data skews learning

Black swan ignorance: AI can’t predict what it’s never seen (e.g., COVID-19 crash)

🔄 Adaptability and Retraining: The Key to Better Performance

Some newer AI systems feature:

Online learning: Adapting to new data in real time

Hybrid models: Combining machine learning with rule-based logic

Sentiment recalibration: Filtering noise in real-time headlines

Still, even these advanced techniques have limits when facing rapid macroeconomic shifts.

📊 Real-World Example: AI Missteps in Bear Markets

During the 2020 pandemic crash:

Many AI trading bots failed to exit positions early.

Sentiment models lagged behind the news due to keyword-based algorithms.

Backtested strategies didn’t include pandemic scenarios, leading to high portfolio losses.

📉 Lesson: Real-world, unpredicted events expose AI’s lack of judgment and foresight.

🧩 How to Use AI Effectively in Both Markets

To navigate AI’s limitations in bear vs. bull markets, investors must:

✅ Cross-validate AI outputs

Use at least two sources for confirmation

Check technical indicators manually

✅ Monitor macroeconomic signals

AI may not account for Fed decisions, interest rate hikes, or inflation shocks.

✅ Don’t automate everything

Allow room for human intervention or override.

✅ Understand model transparency

If you use a tool, know whether it’s rule-based, sentiment-driven, or predictive.

🛠️ Top Free AI Tools and Their Strengths/Limits

| Tool | Strength | Limitation |

|---|---|---|

| FinBrain | Sentiment Analysis | Lags in extreme volatility |

| Ziggma | Visual Fundamental Data | Limited prediction accuracy |

| Tickeron | Pattern Recognition | False signals in panic markets |

| Simply Wall St | Visual valuation + simplicity | Weak real-time adaptation |

| AlphaSense | NLP on earnings calls | Requires paid tier for depth |

🤖 Should You Trust AI in Every Market Phase?

No, and here’s why:

AI thrives in normalcy: Predictable environments, balanced sentiment, and medium volatility.

AI fails in extremity: Sudden selloffs, irrational behavior, and geopolitical shocks.

AI is not a fortune teller. It’s a data pattern recognizer. Use it for confirmation, not blind faith.

🧠 Final Thoughts

Understanding AI’s limitations in bear vs. bull markets is essential for any investor relying on automation or algorithmic suggestions. While AI adds efficiency and speed, it doesn’t replace strategic thinking, macro awareness, or risk management.

When paired with thoughtful investing principles, AI can become a valuable assistant—but only if you’re aware of when and where it tends to fail.

✅ Summary Table

| Element | Bull Market Behavior | Bear Market Behavior |

|---|---|---|

| Price Trend Prediction | Overconfident in growth | Underreactive to falls |

| Sentiment Interpretation | Accurate in stable conditions | Confused by panic, sarcasm |

| Liquidity Awareness | Moderate to good | Often inaccurate |

| Bias | Trend continuation | Bullish bias persists |

| Risk Management | Weak (underestimates correction) | Fails in chaotic periods |

Pingback: Why Free AI Tools Are Not Get Rich Quick Schemes: The Truth Investors Must Know - Trade Pluse Ai