🧠 Summary

In this in-depth guide, we explore how free AI-powered financial tools are revolutionizing personal investing. From eliminating research costs to reducing trading fees, these tools are leveling the playing field for everyday investors. You’ll learn how to use them strategically, avoid traps, and maximize every rupee or dollar invested—without spending a dime.

Table of Contents

Introduction to Free AI Tools in Finance

Hidden Costs of Traditional Investing

How AI Tools Reduce or Eliminate These Costs

Best Free AI Tools for Investors (2025 List)

Real-Life Cost Savings with AI: Case Studies

How to Build a Zero-Cost Investment Strategy

Avoiding the “Free Trap”: What to Watch Out For

Comparing Free vs Paid AI Tools

AI and the Psychology of Smart Spending

Final Thoughts & Getting Started

1. Introduction to Free AI Tools in Finance

Free AI-powered tools are no longer experimental—they’re mainstream. These apps and platforms use algorithms, big data, and machine learning to do what expensive advisors or complex software once did.

Whether it’s analyzing mutual funds, suggesting SIPs, or optimizing a portfolio, you can now access it for free—and often instantly.

🔍 SEO Keywords:

free AI investing tools

zero-cost stock analysis

best free AI financial apps

2. Hidden Costs of Traditional Investing

Before AI, even a small investor faced steep costs:

High brokerage fees

Costly research subscriptions

Time-intensive decision-making

Emotional trading errors

Expensive financial advisors

These hidden costs could eat into 10–30% of profits annually.

3. How AI Tools Reduce or Eliminate These Costs

AI tools eliminate major expense categories:

| Traditional Cost | Free AI Alternative |

|---|---|

| Research fees | AI stock scanners |

| Advisory fees | Robo-advisors |

| Technical analysis tools | AI chart bots |

| Emotional bias | Algorithmic trading rules |

| Tax planning cost | AI tax estimators |

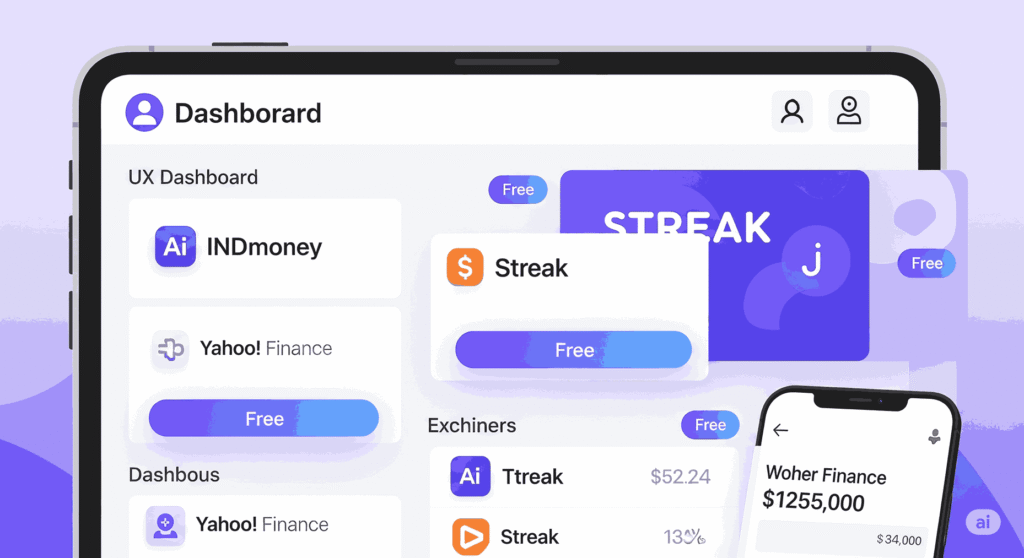

4. Best Free AI Tools for Investors (2025 List)

Here’s a curated list of top-performing, 100% free or freemium AI platforms for smart investing:

🇮🇳 For Indian Investors

INDmoney – Portfolio tracking, AI-based suggestions

Zerodha Streak (Free Plan) – Rule-based trading system builder

Smallcase (Free Portfolios) – Thematic investing powered by data

🌍 Global/US Investors

Yahoo Finance AI Tools – Sentiment & trend analysis

Seeking Alpha (Free Tier) – Crowd-powered AI ratings

Wealthfront (Robo Advisor) – Free tax-loss harvesting

ChatGPT (Free Tier) – Natural language research queries

5. Real-Life Cost Savings with AI: Case Studies

📈 Case 1: Radhika (India)

Used: INDmoney + Zerodha

Saved: ₹7,500 annually in advisory and mutual fund commission fees

Result: Higher SIP returns due to better fund selection by AI

📉 Case 2: Mark (USA)

Used: Wealthfront

Saved: $180/year in rebalancing and tax planning

6. How to Build a Zero-Cost Investment Strategy

🛠 Step-by-Step:

Pick a free AI tool that suits your goals

Start a paper trade or test portfolio

Use AI suggestions to refine your investments

Turn on auto alerts and rebalance notifications

Repeat monthly, track progress in-app

💡 Bonus:

Many AI tools include tax estimators and budgeting tools—use them to optimize spend and save more to invest.

7. Avoiding the “Free Trap”: What to Watch Out For

Some tools use the “free” label but push users toward:

Paid premium plans (with little added value)

Partnered funds with hidden commissions

Ad-based models that distract or bias decisions

Tips to Stay Safe:

✅ Read fine print

✅ Avoid pushy notifications

✅ Compare AI suggestions with public data

✅ Choose platforms with transparency scores

8. Comparing Free vs Paid AI Tools

| Feature | Free AI Tools | Paid AI Tools |

|---|---|---|

| Portfolio tracking | ✅ | ✅ |

| Basic trade suggestions | ✅ | ✅ |

| Backtesting strategies | ⚠️ Limited | ✅ Advanced |

| Personalized reports | ❌ | ✅ |

| Ad-free experience | ❌ | ✅ |

Verdict:

Start with free tools until your portfolio justifies paid upgrades.

9. AI and the Psychology of Smart Spending

AI helps reduce impulsive decisions, which often cost money.

With AI:

You avoid emotional trading

You get goal-based nudges

You receive alerts based on logic, not fear

This helps you not only save money but also invest wisely—with purpose.

💬 “AI teaches discipline, the most underrated form of financial intelligence.”

10. Final Thoughts & Getting Started

The zero-cost advantage isn’t just a catchphrase. With the right AI tools, you can eliminate unnecessary expenses, make smarter moves, and grow your wealth—starting today. No subscriptions. No brokers. No excuses.

✅ Getting Started Checklist

| Step | Task |

|---|---|

| ✅ | Choose 1–2 AI tools from the list |

| ✅ | Set up account & complete KYC |

| ✅ | Start with ₹1,000 or $25 test investment |

| ✅ | Enable alerts & use auto portfolio tracking |

| ✅ | Track your savings from fees monthly |

Pingback: How AI Stock Analysis Life Changing Small Investors to Succeed. - Trade Pluse Ai