1. Introduction

Building confidence: how AI tools empower new investors in 2025 by offering guidance, automation, personalized insights, and risk management—learn how to start investing smartly today.

Investing can feel daunting for beginners—but AI tools are here to change that by boosting confidence, clarity, and control. In 2025, platforms like robo-advisors, AI-powered insights, and automated guidance are democratizing finance, helping new investors go from hesitant to knowledgeable—all without needing a degree in economics.

This 2,000-word guide covers:

The confidence gap for novices

Key AI tool types that help

How AI builds trust step-by-step

Real-world stories and expert findings

Risks to watch and best practices

Actionable steps to start (and grow)

2. Why New Investors Lack Confidence

Information overload: complex terms and charts

Fear of mistakes: losing money can be paralyzing

Lack of guidance: no access to advisors

Choice anxiety: too many options with unclear outcomes

AI solves these through structure, automation, and transparency.

3. AI Tools That Boost Investor Confidence

3.1 Robo-Advisors

Platforms like Betterment automate portfolio creation, rebalancing, and tax optimization

Users set goals and risk levels; the AI builds a diversified portfolio—no guesswork.

3.2 AI-Driven Stock Insights

Tools like TipRanks scan analyst ratings, insider actions, and social data—providing simple “Smart Scores” for decisions

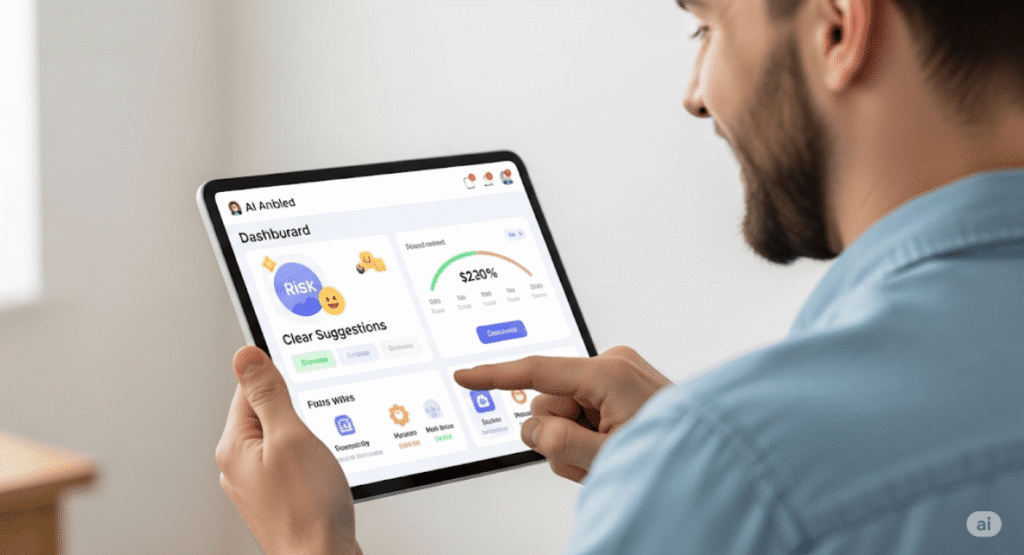

Moomoo, via Cortex, and Public’s Alpha, parse earnings calls and filings to transform raw data into clear suggestions 1.

3.3 Sentiment Analysis Tools

Platforms synthesize financial news, tweets, and sentiment to flag trends early.

This helps novices understand market mood without sifting through noise.

3.4 Automated Alerts & Risk Warnings

Apps provide alerts for unusual price moves—or prompt you to reconsider based on volatility.

Automated educational nudges (“Want to learn more about why this stock is spiking?”) build confidence.

4. How AI Builds Confidence Step-by-Step

| Feature | How It Helps Beginners | Benefit |

|---|---|---|

| Goal-Based Onboarding | Guides you through risk, timeframe, and amount | Personalized starting point |

| Easy Portfolios | Constructed within minutes | Ownership of strategy |

| Visible Outputs | Dashboards and trend visuals are intuitive | Data-not-emotion decisions |

| Human-Readable Alerts | “Review allocation—it’s overweight in tech” | Learning while acting |

| Risk Analytics | Built-in tools monitor volatility and drawdowns | Avoids panic selling |

| Progress Feedback | Reports show growth and habits | Reinforces good behavior |

5. Real-World Evidence

Robinhood and Public reports show new investors feel more informed and engaged thanks to features powered by AI tools like Cortex and Alpha

StockBabble, a conversational AI agent, saw 73% of new users report higher confidence after using it

World Economic Forum studies confirm AI platforms are democratizing access to institutional-grade tools

6. Case Example: Empowering a Beginner

Meet Priya, a 25-year-old teacher who wants to invest but fears losing money:

She downloads a robo-advisor, answers questions about goals and tolerance

AI builds her portfolio, splitting assets across ETFs

She receives easy-to-understand weekly performance updates

When tech stocks boom, she gets an alert—“Your allocation is up 30%, do you want to rebalance?”

Curious, she taps “Learn why,” and AI gives a sentence-level explanation

Over time, Priya gains trust, learns basics, and starts investing on her own

By turning uncertainty into structured learning, AI tools empower her to continue building.

7. Confidence Isn’t Overconfidence

AI does not eliminate risk—but it helps control emotional responses:

No panic-selling during dips

Data-driven alerts keep you grounded

Explainable outputs build trust instead of blind reliance

Experts caution against “automation bias”—trust the AI, but verify when necessary

8. Risks & Best Practices

Over-reliance: always validate AI suggestions

Hallucinations and errors: cross-check, especially with LLM-based insights

Data privacy: select reputable platforms

Complacency: use AI as a teacher, not a crutch

Best practices:

Check if AI model displays reasoning (“why it suggests rebalancing”)

Set your goals and revisit them quarterly

Use demo modes to learn without real money

Educate yourself on investing basics alongside AI insights

9. Getting Started in 2025

Pick a friendly robo-advisor (Betterment, Wealthfront, Zerodha’s Smart ETFs)

Download an AI-capable brokerage app (Moomoo, Public, Robinhood)

Spend time learning from alerts and insights daily

Use small amounts—$50–$100 to begin

Experiment with conversational tools like StockBabble to ask questions

Track your learning journey: note questions you ask and insights you apply

10. The Future: Even Smarter AI Coaches

Conversational interfaces: chat with AI about portfolio conditions

Augmented reality visuals: contextual charts during webinars

Stress detection: AI sense emotional tone and suggest reflective pauses

Goal integration: AI bridges investing with personal goals coaching

This trend is only growing stronger.

✅ Final Takeaways

Free AI tools are closing the gap between beginners and pros

They build confidence through clear guidance, automation, and personalization

Use them as partners—learn, question, and grow alongside

In 2025, AI is the coach that empowers your investing mindset

Pingback: The Importance of Data Quality in Free AI Analysis | 2025 Guide - Trade Pluse Ai