🧩 Introduction – The Evolution of Free AI Tools in the Stock Market

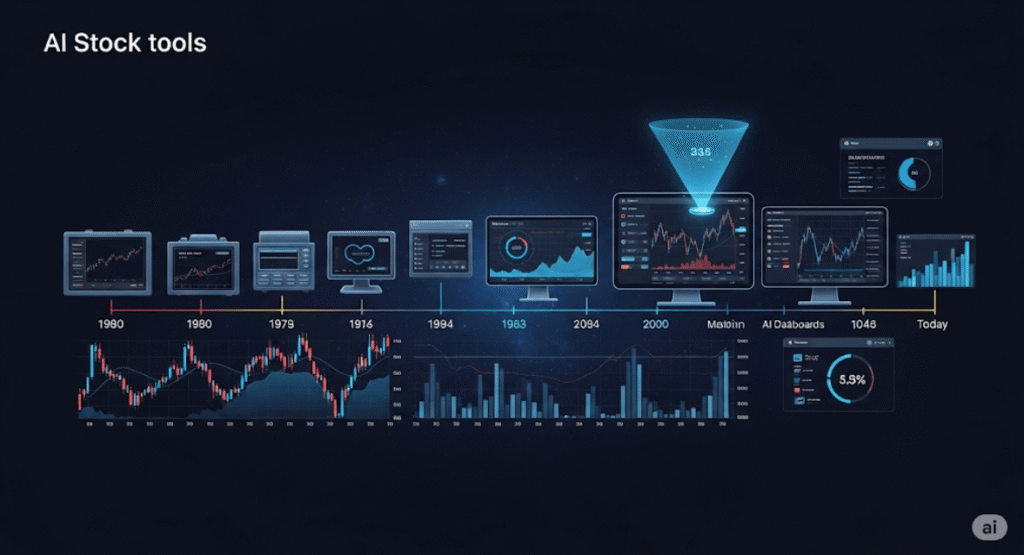

The evolution of free AI tools in the stock market has dramatically reshaped how retail investors access and leverage technology in trading. What began with standalone charting software in the 1980s has matured into powerful platforms offering interactive visualizations, sentiment analysis, predictive bots, and open-source models—often at no cost.

This article traces that journey, covering:

📜 A historical overview

🔧 Landmark tools and platforms

🤖 Key technological breakthroughs

✅ Popular free AI stock-trading tools in 2025

📉 Real-world examples and case studies

🌐 The future—open-source, democratization, and regulation

Let’s dive in.

1. 📜 From Manual to Smart: A Historical Overview

1.1 Early Charting Tools (1980s–1990s)

The foundation was laid with platforms such as MetaStock and The Technician, which automated technical analysis for PC users in the 1980s and 1990s. These tools gathered price data and displayed indicators, giving individual investors charting capabilities previously reserved for professionals.

1.2 Algorithmic Trading and HFT (2000s–2010s)

As computing power grew, so did algorithmic strategies—especially on institutional levels. High-frequency trading (HFT) firms like Renaissance Technologies used early AI (rule-based and simple ML) to dominate seconds-scale trading .

1.3 Democratization Through Open-Source (2010s–2020s)

With platforms like Quantiacs (open algo marketplace) and advances in open-source frameworks (e.g., TensorFlow, PyTorch), hobbyists could build and test AI-driven trading strategies en.wikipedia.org.

1.4 Rise of Free Visual Analysis Tools (2020s)

Free platforms such as Google Finance revamped investor dashboards and introduced interactive charts. Google’s recent rollout of AI‑enhanced stock visualizations exemplifies this trend.

2. 🔧 Pivotal Technological Advancements

2.1 Interactive AI-Enhanced Charts

Google recently added interactive, AI-generated charts powered by Gemini in Search—allowing users to explore and converse with stock data in real time androidcentral.com.

2.2 Generative & Predictive Models

Research-grade systems like StockGPT scan decades of returns to generate trading signals using generative transformer models arxiv.org.

2.3 Sentiment Analysis & NLP

Natural language processing transforms financial news and social media sentiment into trade signals. Tools like TipRanks aggregate expert opinions and deliver sentiment analysis freely.

2.4 Crowd-Sourced Quantitative Platforms

Platforms like Numerai and Quantiacs allow quants to contribute models, while returns are shared—blurring the line between amateur and institutional investors en.wikipedia.org.

3. 🛠️ Top Free AI Tools for Stock Trading in 2025

3.1 Google Finance + AI Mode

Interactive charts and guided dialogues for retail users

Free portfolio tracking

AI summaries and intuitive data visualization

3.2 TipRanks (Freemium)

AI-based analyst ranking engine

Tracks insider trading, blogs, and ratings in real-time

3.3 Numerai

Crowd-sourced quant strategies

Users contribute models; AI synthesizes predictions

3.4 Quantiacs

Python-based backtesting and marketplace

Free access to strategy testing

3.5 Incite AI

Free AI advisor for personalized guidance m.adsa.org

3.6 Zen Ratings, LevelFields, WallstreetZen

AI-driven stock scores and insights with free tiers

3.7 Trading Bots (e.g., Trade Ideas “Free Flow”, Superalgos)

Free trials or limited access to AI trading bots

4. 📉 Real-World Examples & Case Studies

4.1 Interactive Charts with Google AI

Beta-testing users are exploring Google Search AI Mode’s interactive charts—hovering, querying, and interpreting data instantly androidcentral.com.

4.2 Hedge Funds Go All-In

AQR’s Cliff Asness announced in June 2025 that his firm fully embraced AI since 2018, underlining AI’s mainstream role in investing time.com+1nypost.com+1.

4.3 The Rise of DeepSeek & Open-Source Disruption

Indian-backed startup DeepSeek’s open-source model triggered a massive Nasdaq drop—underscoring that AI innovation can come from anywhere.

5. 📊 Advantages & Challenges of Free AI Tools

🟢 Benefits

Low or zero cost

Democratizes access to advanced analytics

Encourages experimentation

24/7 data insights with minimal learning curve

🔴 Challenges

Limited feature sets

Data latency (delayed real-time)

Lack of customization

Regulatory and ethical risk, especially with financial advice

Nonetheless, free tools are gateway platforms for retail adoption.

6. 🌐 How to Choose the Right AI Tool

Define your goals – analysis, execution, portfolio tracking

Evaluate data accessibility – e.g. real-time vs delayed

Assess transparency & explainability

Start with free platforms like Google Finance, TipRanks

Scale up if needed (e.g., shift to paid AI plans)

7. 🔮 Future Trends in AI Stock Tools

7.1 Advanced Generative Models

Platforms like StockGPT offer generative AI for stock prediction, showing superior performance compared to traditional signals.

7.2 Ethical, Open-Source Alternatives

DeepSeek and other providers offer open-source financial AI models, triggering a shift in approach across Wall Street .

7.3 AI-Powered Regulation & Compliance

Regulators increasingly apply AI to supervise trading activities—complex tools may become mainstream in compliance .

7.4 The Age of Explainable AI (XAI)

Investors demand models with interpretability—console overlays and natural language explanations are growing in adoption.

✅ Conclusion

The evolution of free AI tools in the stock market has taken investors from basic charting software to sophisticated AI systems—all at little to no cost. From MetaStock in the 1980s to Google’s real-time interactive AI charts and emerging platforms like DeepSeek, the democratization of finance continues to accelerate.

For retail investors in 2025, these free AI tools offer:

Real-time insights without the costs

Customizable strategies and sentiment data

Safe experimentation environments

A pathway to more advanced, paid AI systems

Pingback: Understanding AI-Driven Insights: What They Mean for You in 2025 - Trade Pluse Ai