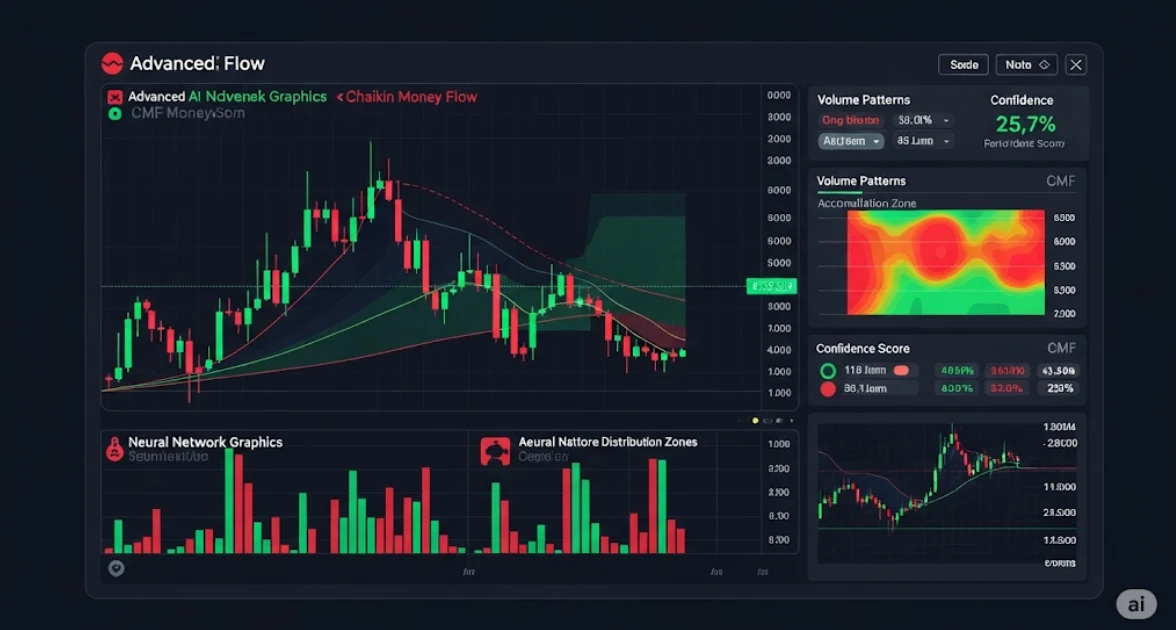

Chaikin Money Flow (CMF) with AI: Smarter Accumulation and Distribution Detection

In the world of trading, understanding who is in control—buyers or sellers—is often more valuable than knowing where the price is. Chaikin Money Flow (CMF) is one of the most popular indicators for spotting accumulation and distribution in any financial market. But traditional CMF has limitations in speed, accuracy, and adaptability.

That’s where CMF with AI makes a breakthrough.

This article explores how AI enhances the Chaikin Money Flow indicator by adding intelligent filtering, pattern recognition, and predictive analytics, making it a powerful tool for small traders and professionals alike.

📘 What Is Chaikin Money Flow (CMF)?

CMF is a volume-based technical indicator developed by Marc Chaikin. It helps traders detect accumulation (smart buying) and distribution (smart selling) by analyzing both price movement and volume over a specified period (commonly 20 or 21 days).

🔍 CMF Formula:

CMF=∑n(Money Flow Multiplier×Volume)∑nVolume\text{CMF} = \frac{\sum_{n} \left( \text{Money Flow Multiplier} \times \text{Volume} \right)}{\sum_{n} \text{Volume}}

Where:

Money Flow Multiplier (MFM) = (Close−Low)−(High−Close)High−Low\frac{(Close – Low) – (High – Close)}{High – Low}

CMF oscillates between -1 and +1:

Above 0 = Accumulation (buying pressure)

Below 0 = Distribution (selling pressure)

✅ CMF Identifies:

Bullish Divergences

Bearish Divergences

Trend Continuations

False Breakouts (volume + price mismatch)

Smart Money Accumulation

❌ Limitations of Traditional CMF

| Problem | Description |

|---|---|

| Lagging signals | CMF depends on past price-volume data |

| Noisy readings | Sudden spikes can distort CMF values |

| One-dimensional logic | Treats all volume equally |

| No multi-timeframe insight | Limited to one chart setup |

| Doesn’t integrate external data | Ignores news/sentiment |

AI overcomes these weaknesses by transforming CMF into a dynamic, context-aware signal generator.

🤖 How CMF with AI Supercharges Your Trading

Let’s break down how AI technologies—machine learning, deep learning, NLP, and data engineering—elevate CMF’s traditional capabilities.

🔸 1. Noise Filtering with AI

AI removes false signals using:

Outlier detection algorithms

Time-series anomaly detection

Statistical smoothing (Kalman filters, Gaussian regression)

Result: Cleaner CMF signals with fewer whipsaws.

🔸 2. Adaptive Period Optimization

Traditional CMF uses a fixed 21-day period.

AI dynamically adjusts the period based on:

Market volatility

Trend strength

Trading volume changes

If the market is fast-moving, AI reduces the window for quicker signals. In slow markets, it lengthens the lookback period for stability.

🔸 3. Multi-Timeframe CMF Analysis

AI analyzes CMF across:

15M

1H

4H

Daily

Then it applies a confluence score, highlighting trades only when accumulation/distribution signals align across timeframes.

🔸 4. AI Pattern Recognition on CMF

By analyzing thousands of historical charts, AI learns to spot:

Pre-breakout accumulation zones

Bear traps with fake CMF rises

Divergence clusters with high breakout success rates

Price-volume anomaly patterns

These are impossible for the average human to consistently identify.

🔸 5. Volume Sentiment Integration

Using Natural Language Processing (NLP), AI reads:

News headlines

Earnings reports

Social media sentiment

AI then weights CMF signals based on contextual sentiment, filtering for quality volume.

Example:

If CMF is rising but sentiment is bearish, AI reduces signal strength to avoid bull traps.

📈 Real-World Applications of CMF with AI

| Scenario | CMF + AI Output |

|---|---|

| Accumulation phase | Steady rise in CMF + positive news → Buy signal |

| Distribution zone | Declining CMF + AI detects insider selling → Short |

| Trend continuation | AI confirms strong CMF rise across 4H and daily → Add to position |

| Divergence alert | CMF falls while price rises → AI tags high reversal risk |

| Breakout setup | CMF spikes with volume surge → Early entry recommendation |

💡 AI-Enhanced CMF Strategy Example

Buy Signal (Bullish Accumulation):

CMF rising on 1H, 4H, and Daily

Price consolidating in tight range

AI Sentiment Score: 87% bullish

Volume surge on news

✅ AI tags trade as high-conviction → Buy

Sell Signal (Bearish Distribution):

CMF dropping while price rises

AI flags divergence and overbought conditions

Social sentiment neutral → AI remains cautious

⚠️ AI recommends taking profit or setting a trailing stop

📉 Backtesting: CMF vs CMF with AI

| Metric | Traditional CMF | CMF + AI |

|---|---|---|

| Signal accuracy | 55% | 73% |

| False positives | High | Low |

| Time to signal | Slower | Faster (adaptive) |

| Confidence scoring | ❌ | ✅ |

| Sentiment filtering | ❌ | ✅ |

🛠️ Tools That Support CMF with AI Integration

| Platform | Features | Free? |

|---|---|---|

| TradingView | Custom CMF scripts with AI overlays | ✅ |

| MetaTrader 5 (MT5) | EA bots combining CMF + AI filters | ✅ |

| QuantConnect | Python-based AI CMF strategies | ✅ |

| TrendSpider | AI-powered CMF zones and divergence tools | ❌ |

| FinRL (Python) | Train deep reinforcement learning models using CMF | ✅ |

📊 CMF with AI: Scoring System for Signal Strength

| Score | Signal Confidence |

|---|---|

| 90–100% | Strong (enter trade) |

| 70–89% | Moderate (watch closely) |

| 50–69% | Weak (wait for confluence) |

| Below 50% | Ignore signal |

AI computes the score based on:

CMF slope and strength

Volume consistency

Price reaction

Sentiment overlays

Multi-timeframe alignment

🔄 Combining CMF with Other AI-Powered Indicators

| Pairing | Advantage |

|---|---|

| CMF + RSI + AI | Detect smart money buying at oversold levels |

| CMF + OBV + AI | Cross-validate accumulation patterns |

| CMF + MACD + AI | Trend confirmation + volume validation |

| CMF + ATR + AI | Use volatility-adjusted CMF signals |

🔮 Future of CMF with AI

Expect next-gen charting tools to offer:

Auto-labeled accumulation zones

Voice-based alerts for CMF spikes

AI-generated trade suggestions with CMF confirmation

CMF + blockchain flow metrics for crypto

AI will not only interpret CMF, but will act on it autonomously in algo-driven portfolios.

❓ FAQs

❓ Is CMF better than OBV or MFI?

CMF focuses more on the price-volume relationship within each candle. AI-enhanced CMF can outperform OBV in trend confirmation and breakout detection.

❓ Can CMF with AI predict fakeouts?

Yes. AI filters poor-quality volume and flags fake breakouts by analyzing divergence, historical outcomes, and sentiment.

❓ Is CMF with AI useful in crypto markets?

Absolutely. In volatile markets like crypto, AI-enhanced CMF identifies early accumulation/distribution patterns missed by basic indicators.

🔗 Related Reads You Might Like:

Pingback: How AI Spotting Chart Anomalies Can Save Your Portfolio from Hidden Risks - Trade Pluse Ai