📈 AI Screeners for Cyclical Stocks: Master Market Timing with Smart Tools

In the rollercoaster world of investing, few sectors offer the same mix of risk and reward as cyclical stocks. These stocks rise and fall with economic tides—booming in good times and crashing during downturns. That’s why smart investors use AI screeners for cyclical stocks to spot trends, forecast reversals, and optimize entry and exit points.

In this article, we’ll dive deep into how AI screeners for cyclical stocks can give you an edge by predicting market movements, identifying sector rotations, and minimizing emotional decision-making. Ready to time the market better?

Let’s go.

🔄 What Are Cyclical Stocks?

Cyclical stocks are companies whose revenue and share price move with the broader economy. They tend to perform well during economic expansions and underperform during recessions.

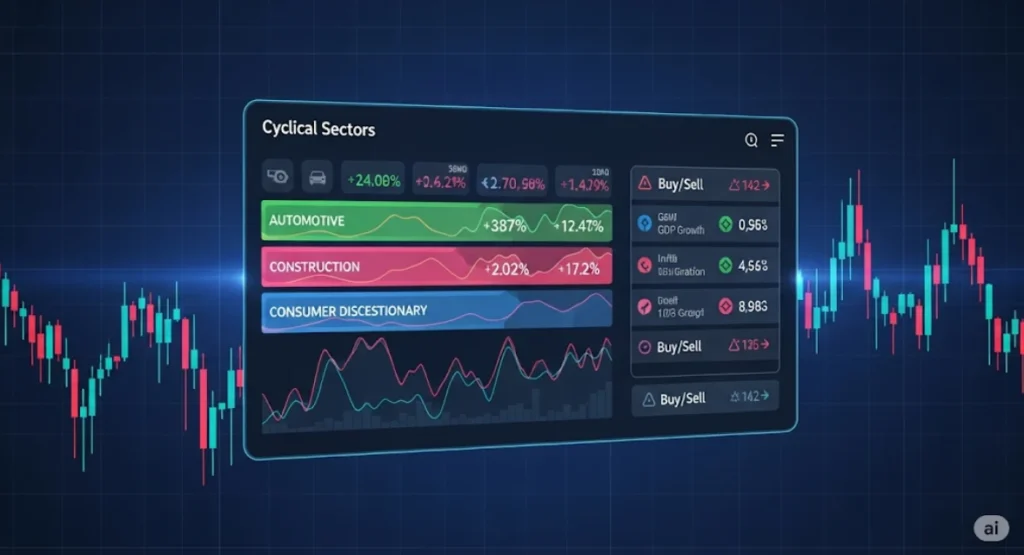

🚀 Examples of Cyclical Sectors:

Automotive (e.g., Ford, Tesla)

Construction (e.g., Caterpillar, Vulcan Materials)

Consumer Discretionary (e.g., Nike, Starbucks)

Travel & Leisure (e.g., Delta Airlines, Carnival)

Industrial Machinery (e.g., Deere & Co.)

🧠 What Are AI Screeners for Cyclical Stocks?

AI screeners for cyclical stocks use artificial intelligence and machine learning to analyze massive amounts of real-time data—including economic reports, consumer trends, earnings cycles, and sentiment—to detect:

📉 Business cycle phases (expansion, peak, contraction, trough)

🔁 Sector rotation patterns

📊 Earnings momentum

📈 Optimal entry and exit points

🧨 Macro risk triggers

These AI screeners automate the most complex parts of timing the market, helping you ride the ups and exit before the downs.

📊 Why Use AI Screeners for Cyclical Stocks?

Here’s how AI gives you an edge over manual analysis:

| Feature | Traditional Research | AI Screener |

|---|---|---|

| Economic Cycle Detection | Manual, delayed | Real-time, automated |

| Earnings Momentum | Quarterly snapshots | Continuous NLP scanning |

| Sector Rotation Insight | Broad indexes | Sub-sector precision |

| Sentiment Analysis | News-focused | Social media + earnings + macro |

| Entry/Exit Timing | Gut-based | AI-optimized triggers |

AI screeners for cyclical stocks remove emotion and inject data-driven discipline into your market timing.

🔍 Best Free or Freemium AI Screeners for Cyclical Stocks

Let’s look at some tools that can help you track and time cyclical stocks efficiently.

1. FinBrain Terminal

🔹 Features:

AI-based sentiment and economic cycle prediction

Stock-specific news analytics

Sector rotation heatmaps

2. Kavout AI Stock Screener

🔹 Features:

“Kai Score” ranks stocks based on AI forecasts

Cyclical sector filters included

Visual trend tracking and economic overlay

3. Tickeron AI Pattern Screener

🔹 Features:

Pattern recognition for cyclicals like head-and-shoulders, flags

Entry/exit signals with probability scores

Includes cyclical-focused ETFs and sectors

4. Ziggma Screener (Freemium)

🔹 Features:

Cyclical sector filters with growth metrics

Real-time macroeconomic alerts

AI-powered performance prediction

5. TradingView with AI Plugins

🔹 Features:

Economic calendar overlays

AI-coded Pine Scripts for timing cyclical sectors

Powerful charting tools for visual cycles

🔧 How to Use AI Screeners for Cyclical Stocks in 5 Steps

Let’s break it down into a real-world strategy:

✅ Step 1: Track the Economic Cycle

Use AI tools like FinBrain to analyze:

GDP growth

Interest rate trends

Consumer confidence

Industrial production

AI will help classify whether we’re in expansion, peak, contraction, or trough—vital for cyclical stock strategy.

✅ Step 2: Identify Cyclical Sectors Ready to Rise

AI screeners scan:

📈 Stock performance vs. GDP cycles

📊 Sector ETFs rotation charts

🔥 AI-predicted momentum

Cyclical sectors often bottom before the economy does—a key edge for early investors.

✅ Step 3: Select Stocks Within Strong Sectors

Filter by:

Earnings growth acceleration

Revenue tied to consumer/business cycles

Price momentum with strong volume

Insider buying or upgrades

AI screeners for cyclical stocks like Kavout or Ziggma make this process frictionless.

✅ Step 4: Use AI to Monitor Entry & Exit Signals

AI models watch:

Technical pattern confirmation (e.g., golden cross, MACD)

News-based earnings previews

Momentum fading or reversing

Tools like Tickeron even assign probabilities to chart patterns, guiding precision trades.

✅ Step 5: Add Macro Sentiment & Risk Filters

Use AI NLP tools to scan:

Federal Reserve commentary

Inflation spikes

Geopolitical risk

Consumer sentiment indexes

This final layer makes sure your cyclical timing strategy is aligned with the big picture.

🧪 Real Case Study: Timing Airlines with AI

Sector: Airlines (highly cyclical)

Tool Used: FinBrain + TradingView

February 2020: AI flagged high recession risk

March 2020: Airline stocks plunged

May 2020: AI detected recovery signs via travel bookings

August 2020: Airline stocks rebounded 40%+

Without AI insights, you’d either panic sell or miss the recovery. AI screeners for cyclical stocks gave timely clarity.

🧭 Best Indicators for Cyclical Stock Timing (AI-Assisted)

| Indicator | Why It Matters |

|---|---|

| Earnings Revision Momentum | AI tracks upward/downward analyst changes |

| Consumer Confidence Index | Higher confidence = more spending |

| Commodity Price Cycles | Many cyclicals are commodity-driven |

| Interest Rate Trends | Impacts borrowing-heavy sectors like autos |

| Retail Sales Data | Tied to discretionary cyclical stocks |

| Real-Time Sentiment | AI pulls tone from earnings calls and media |

📚 Top Cyclical Stock Sectors to Monitor with AI

| Sector | Key Economic Trigger | Volatility |

|---|---|---|

| 🚗 Autos | Consumer credit, gas prices | High |

| 🏗 Construction | Interest rates, permits | Moderate–High |

| 🧥 Consumer Discretionary | Disposable income | Moderate |

| ✈️ Travel & Leisure | Global economy, fuel | High |

| 🔧 Industrials | Business investment cycles | Moderate |

| 🛢 Energy | Global demand | High |

AI helps optimize your entry and exit timing in these swing-heavy sectors.

💡 Tips to Optimize Results with AI Screeners for Cyclical Stocks

⚙️ Use AI with moving averages (50/200 DMA crossover)

💬 Watch earnings call sentiment scores

🌍 Track macroeconomic triggers (jobs, CPI, GDP)

⏱ Set alerts for sector rotation triggers

🧾 Combine with value filters (low P/E during downturns)

AI screeners help you manage both timing and valuation, boosting your cyclical returns.

✅ Final Checklist: AI Screeners for Cyclical Stocks

Identify the current business cycle phase

Scan for rising momentum in cyclical sectors

Choose fundamentally sound cyclical stocks

Confirm entry signals with AI pattern recognition

Monitor macro and sentiment alerts with AI

Use stop-loss and exit alerts based on AI thresholds

Diversify across 2–3 sectors to reduce volatility

📘 Conclusion: Ride the Waves of the Market Like a Pro

AI screeners for cyclical stocks are not about predicting the future with a crystal ball. They’re about using real-time data, smart pattern recognition, and macro insights to make better decisions—faster and more objectively.

✅ Want to catch the next boom?

✅ Avoid the next bust?

✅ Ride industry waves instead of reacting late?

Then it’s time to integrate AI screeners for cyclical stocks into your toolkit.

🔗 Related Reads You Might Like: