🛍️ AI Screeners for Consumer Discretionary: Economic Barometers That Predict the Pulse of Growth

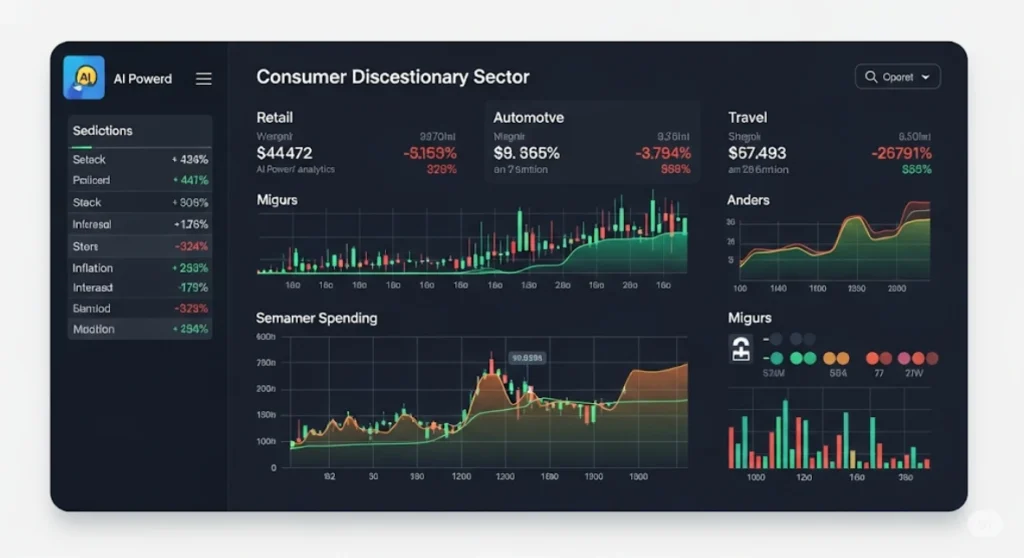

In the stock market, few sectors are as dynamic—and revealing—as consumer discretionary. These companies reflect consumer confidence, income levels, and economic health. From Amazon to Nike, Starbucks to Tesla, discretionary stocks ride the waves of prosperity and contraction. Smart investors are now using AI screeners for consumer discretionary stocks to analyze trends, time entries, and forecast economic shifts.

In this article, we’ll explore how AI screeners for consumer discretionary stocks act as real-time economic barometers and how to use free AI tools to find the best opportunities.

🧾 What Is the Consumer Discretionary Sector?

The consumer discretionary sector includes non-essential goods and services that people buy when their disposable income is high. These purchases are often delayed or reduced during downturns, making this sector sensitive to economic cycles.

📦 Common Consumer Discretionary Categories:

Retail (e.g., Amazon, Macy’s)

Automotive (e.g., Tesla, Ford)

Travel & Leisure (e.g., Carnival, Expedia)

Apparel & Footwear (e.g., Nike, Lululemon)

Restaurants (e.g., Starbucks, McDonald’s)

📉 Why Track Consumer Discretionary with AI?

Consumer discretionary performance often precedes or reflects economic changes. That’s why economists and institutional investors watch this sector closely. But instead of relying on delayed earnings or government reports, retail traders can use AI screeners for consumer discretionary to gain real-time insights.

🤖 What Are AI Screeners for Consumer Discretionary?

AI screeners for consumer discretionary stocks leverage artificial intelligence and machine learning to analyze:

Consumer sentiment

Sales trends and earnings growth

Social media and search behavior

Macro indicators (GDP, inflation, jobs)

Industry rotation signals

They automate deep-level research and spot early signs of bullish or bearish moves within the sector.

✅ Advantages of Using AI Screeners for Consumer Discretionary

Benefit — Traditional Screener / AI Screener

Filter by sector — ✅ / ✅

Track earnings — ✅ / ✅

Sentiment analysis — ❌ / ✅

Macro trend overlays — ❌ / ✅

Social signals — ❌ / ✅

AI ranking/scoring — ❌ / ✅

Recession warning signs — ❌ / ✅

AI screeners for consumer discretionary bring clarity to a complex, fast-moving sector.

🔍 Top Free AI Screeners for Consumer Discretionary

Here are the best free or freemium tools to explore consumer discretionary stocks through an AI lens:

1. Kavout – AI-Powered Kai Score

Features:

Sector-specific scoring

AI ranks discretionary stocks based on growth and sentiment

Earnings forecast modeling

📍 https://kavout.com

2. FinBrain Terminal

Features:

Real-time news and consumer sentiment for retail/leisure stocks

Forecasting based on AI trend analysis

Sector risk scoring

📍 https://finbrain.tech

3. Seeking Alpha Quant Ratings

Features:

Discretionary filters (restaurants, apparel, etc.)

AI-based quant scores (Value, Growth, Profitability)

Analyst revision tracking

📍 https://seekingalpha.com

4. TradingView with Pine Script AI Bots

Features:

Build custom AI filters using beta, RSI, and discretionary ETF performance

Visual earnings and retail sales overlays

Works with XLY (consumer discretionary ETF)

📍 https://tradingview.com

5. Ziggma Screener

Features:

Consumer discretionary focus with AI quality scoring

Sales momentum and risk profile tracking

Free tier with basic filters

📍 https://ziggma.com

🧠 How to Use AI Screeners for Consumer Discretionary Like a Pro

Here’s a step-by-step guide to leverage AI screeners for consumer discretionary in your portfolio strategy.

✅ Step 1: Start with Macroeconomic Indicators

Track:

Consumer Confidence Index (CCI)

Retail sales trends

Unemployment rates

Inflation and interest rate data

AI screeners use these to model economic expansion or contraction, predicting the health of consumer discretionary stocks.

✅ Step 2: Filter for Strong Sub-Sectors

Use AI tools to identify:

Apparel growth vs. retail contraction

Travel and leisure rebound trends

EV sales momentum (automotive)

The sector is broad—AI helps focus your lens on outperforming areas.

✅ Step 3: Apply Smart Growth & Sentiment Filters

Look for:

Positive earnings revisions

Rising consumer reviews or sentiment

Stable to growing profit margins

Low debt-to-equity and strong brand equity

AI screeners highlight companies consumers are actually engaging with, not just legacy names.

✅ Step 4: Compare with Discretionary ETFs

Benchmark individual stocks against:

XLY (Consumer Discretionary Select Sector ETF)

VCR (Vanguard Consumer Discretionary ETF)

FDIS (Fidelity Discretionary Index ETF)

AI tools can overlay ETF movement with stock price to detect alpha opportunities.

✅ Step 5: Monitor Trends with Alerts

Set AI alerts for:

Analyst upgrades or downgrades

Sector rotation signals (moving out of defensives into discretionary)

Unusual volume or price breakouts

Sentiment score shifts

This keeps you ahead of the curve in a fast-shifting sector.

📊 What Metrics to Track with AI Screeners for Consumer Discretionary

Metric — Purpose

Revenue growth — Indicates rising consumer demand

EPS forecast accuracy — AI measures credibility of growth

Operating margin — Strong brands command higher margins

Price/Sales ratio — Good for comparing retailers and apparel

Sentiment Score — AI-analyzed from news and social media

Beta — To understand stock volatility

Debt/Equity — Consumer cyclical stocks can be overleveraged

AI tools help automate this data pull and flag anomalies before humans can.

📈 Real-World Example: AI Timing with a Travel Stock

Company: Expedia (EXPE)

Tool: FinBrain + TradingView

Q3 2022: AI detected strong sentiment from post-COVID travel trends

Retail sales and airline booking surged

FinBrain flagged upward revision trend

Price jumped 35% over next 3 months

Without AI tools, spotting this early would require hours of research. AI screeners for consumer discretionary made it efficient.

💡 Expert Tips for Using AI Screeners for Consumer Discretionary

Use macro + micro AI filters together

Don’t treat all discretionary stocks the same—travel ≠ apparel

Watch for holiday season sentiment and retail trends

Use AI to monitor CEO/CFO earnings call tone (NLP-based)

Avoid high beta discretionary stocks in recession warnings

🧾 Defensive vs. Discretionary: Know When to Shift

Market Condition — Sector Preference

Booming Economy — Consumer Discretionary

High Inflation — Mixed—look for pricing power

Rising Rates — Defensive (Consumer Staples)

Recession — Healthcare, Utilities

AI screeners often automatically adjust scoring based on macroeconomic inputs.

✅ Final Checklist: AI Screeners for Consumer Discretionary

Filter by sector: Retail, Auto, Travel, Restaurants

Review AI sentiment scores

Check earnings revisions and analyst momentum

Analyze macro indicators alongside stock movement

Compare with XLY, VCR ETFs

Monitor news, price action, volume shifts

Reassess position during economic inflection points

📘 Conclusion: AI Makes Consumer Discretionary Smarter

The consumer discretionary sector tells us what people are willing to spend on when they feel secure—and what they abandon when belts tighten. It’s one of the best market sentiment indicators and growth engines in bull markets.

But instead of guessing or chasing headlines, you can use AI screeners for consumer discretionary to:

✅ Spot early winners in changing economies

✅ Time entries during rotation from defensive stocks

✅ Analyze earnings and sentiment faster

✅ Reduce research time while increasing accuracy

Let AI guide your discretionary stock strategy with data, not emotion.

🔗 Related Reads You Might Like:

Pingback: Utilities Sector with AI Screeners: Unlocking Stable Income (2025) - Trade Pluse Ai