AI-Driven Volume-Price Analysis (VPA) for Small Investors: Smarter Trades with Less Capital

The combination of volume and price action is a time-tested formula for smart trading. It helps traders understand the strength behind a move, identifying whether a price change is real—or just noise. But mastering Volume-Price Analysis (VPA) requires years of experience.

Now, AI-driven Volume-Price Analysis for small investors is leveling the playing field. By automating data processing and pattern recognition, artificial intelligence is giving small traders access to professional-grade tools.

In this guide, we explore how AI makes VPA accessible, affordable, and actionable—even if you’re starting with just a few hundred dollars.

📊 What is Volume-Price Analysis (VPA)?

Volume-Price Analysis (VPA) is a technical trading method that evaluates the relationship between price movement and trading volume. The core principle is:

“Price movement without volume is weak. Volume confirms price direction.”

🔹 VPA Core Concepts:

High Volume + Rising Price = Strength, possible continuation

Low Volume + Rising Price = Weak move, possible reversal

High Volume + Falling Price = Panic selling or smart money exiting

Low Volume + Falling Price = Lack of interest, indecision

This method helps detect:

Breakouts

Traps

Exhaustion points

Smart money accumulation or distribution

But analyzing volume-price behavior manually is hard—especially in fast-moving markets. Enter AI.

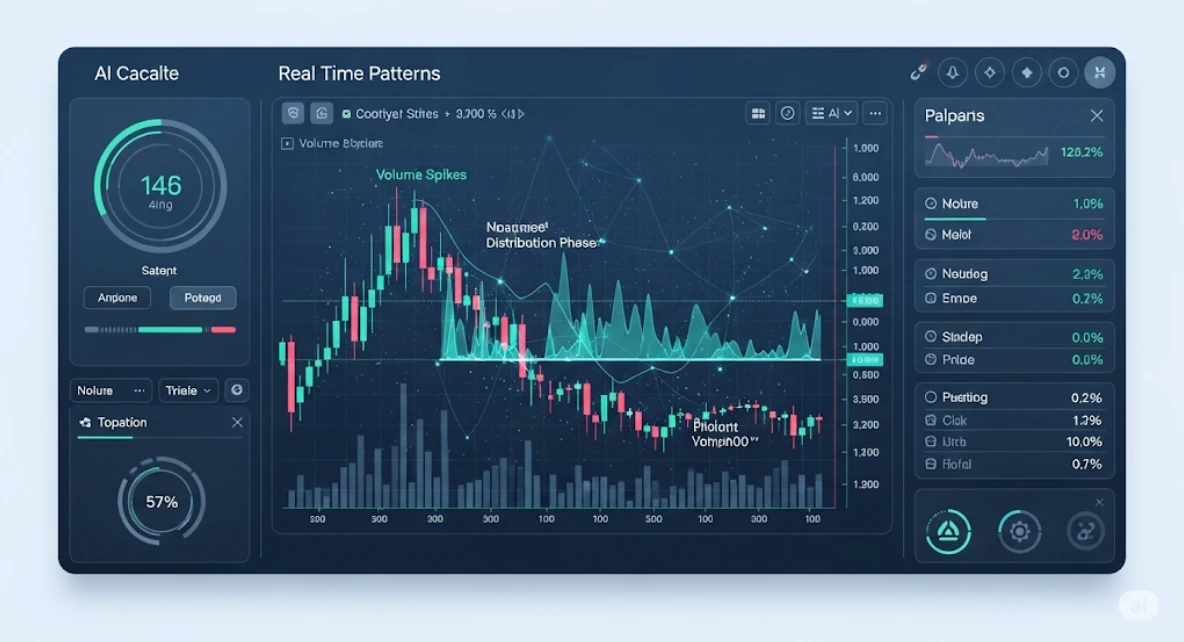

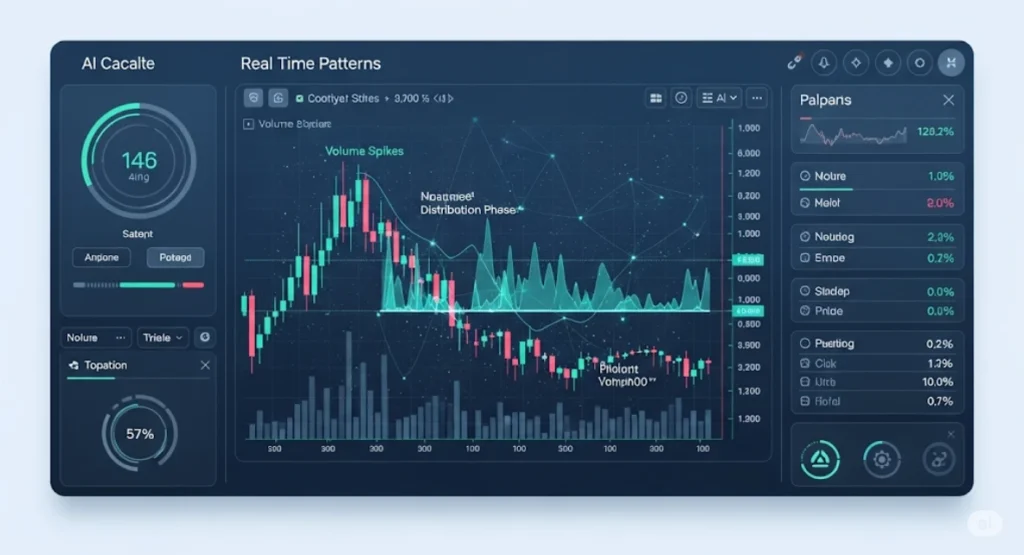

🤖 How AI Improves Volume-Price Analysis for Small Investors

✅ 1. Pattern Recognition at Scale

AI can detect:

Volume spikes

Divergences

Accumulation/distribution zones

Reversal volumes

Instead of eyeballing charts, AI analyzes thousands of price-volume patterns and learns what typically follows.

✅ 2. Contextual Volume Reading

AI models can understand the context:

Is the volume spike after a breakout or before earnings?

Is the low volume during a range or near resistance?

This context-driven approach mimics what expert traders do—only faster and more accurately.

✅ 3. Predictive Modeling

By using machine learning (e.g., Random Forests, LSTM networks), AI models can:

Forecast the probability of a breakout

Predict exhaustion zones

Identify volume-supported reversal signals

This helps small investors make more informed, lower-risk decisions.

🛠️ AI VPA Tools for Small Investors

Here are some of the best free or low-cost AI tools for VPA that are ideal for beginners and small accounts:

| Tool | Key Features | Free? |

|---|---|---|

| TradingView + AI Volume Indicators | Custom Pine Script indicators for VPA | ✅ |

| Finviz Elite (Volume Heatmaps) | Visual screening of volume surges | ❌ (low cost) |

| AutoChartist | AI-based volume and price pattern scanner | ✅ via brokers |

| MetaTrader + AI Indicators | Custom volume AI scripts in MQL4/5 | ✅ |

| ChatGPT + Python API (Pandas + Scikit-Learn) | Build custom AI VPA models | ✅ |

🧠 How AI-Driven VPA Works Step-by-Step

🔍 Step 1: Collect Data

AI models ingest:

OHLCV (Open, High, Low, Close, Volume) data

Historical events (earnings, news)

Technical levels (support, resistance)

🔍 Step 2: Feature Engineering

AI builds new data points like:

Volume Moving Averages

Price-Volume Divergence

Volume Spikes vs. Baseline

Relative Volume Indicators (RVI)

🔍 Step 3: Train Predictive Model

Models like XGBoost, Random Forest, or Neural Networks are trained on historical chart patterns labeled as:

“Breakout success”

“False breakout”

“Reversal zone”

These patterns include volume/price behaviors

🔍 Step 4: Generate Trading Signals

The model outputs:

Probability of breakout

Signal confidence score

Entry/exit suggestions based on volume confirmation

💡 Example: AI VPA in a Small-Cap Stock

Let’s say you’re watching XYZ, a low-float stock priced at $3.50. AI-driven VPA:

Detects volume spike 5x average with price breaking past $3.60

Confirms the move by comparing to 50+ similar historical patterns

Sends a buy alert: 72% probability of follow-through

With $300, you take a small position. Price hits $4.10 in 30 minutes. You secure 15% profit based on smart VPA and zero guesswork.

📈 Popular AI VPA Signals Small Investors Should Know

| Signal | What It Means | AI Interpretation |

|---|---|---|

| Climactic Volume Bar | End of a move | Probable reversal zone |

| Low Volume Pullback | Weak selling | Continuation likely |

| High Volume Breakout | Strong conviction | Valid breakout |

| Volume Divergence | Price up, volume down | Bearish warning |

| Trap Volume | Volume spike + reversal candle | Fake move warning |

⚖️ Human vs. AI in Volume-Price Analysis

| Feature | Human Trader | AI Trader |

|---|---|---|

| Volume Reading | Based on gut/experience | Data-driven |

| Speed | Slow, subjective | Instant |

| Emotion | Prone to bias | None |

| Scalability | One chart at a time | 1,000s simultaneously |

| Learning Curve | High | Low (pre-built or code-based) |

📉 Why Small Investors Should Use AI VPA

🔸 1. Low Capital, High Precision

When you have limited funds, precision matters more than frequency. AI-VPA helps filter high-confidence setups with strong volume confirmation.

🔸 2. Time-Saving

Most small investors trade part-time. AI tools alert you when a valid VPA signal occurs—no need to stare at charts for hours.

🔸 3. Risk Management

AI-driven VPA flags traps and fakeouts early. This helps avoid common retail mistakes like:

Chasing breakouts without volume

Buying into distribution phases

🧪 AI-Powered VPA Strategy for Small Traders

Strategy: Breakout Confirmation with AI-VPA

Filter stocks with volume > 200% average

Confirm price breaks above resistance

Use AI model to check:

Volume pattern matches historical breakouts

Confidence score > 70%

Entry = breakout candle close

Stop = below support

Target = 2:1 risk-reward

Test this on 100+ setups with backtesting. You’ll see how AI-VPA improves the odds.

🔗 Related Reads You Might Like:

Pingback: Understanding AI-Generated Heatmaps in Charting Tools: A Trader's Visual Edge - Trade Pluse Ai