ADX and AI: Smarter Trend Strength Analysis for Better Trading

Traders rely on trend-following strategies to ride momentum and avoid choppy markets. But the big question always remains: Is this a strong trend or a fake move?

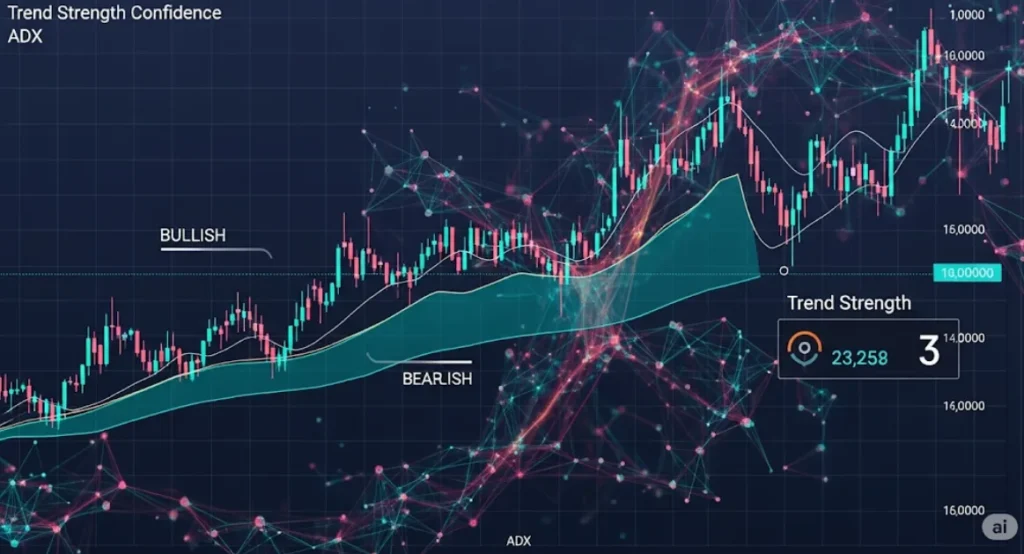

That’s where the Average Directional Index (ADX) comes into play. ADX is a classic technical tool for measuring trend strength, but on its own, it has limitations. Today, thanks to artificial intelligence, we now have smarter, adaptive ways to use ADX and AI together for more accurate market insights.

In this guide, we’ll explore what ADX is, how it works, and how AI enhances its power for better timing, risk management, and confidence in your trading decisions.

📊 What Is the ADX (Average Directional Index)?

Developed by J. Welles Wilder, the ADX is a momentum indicator used to measure the strength of a trend, regardless of its direction.

It’s part of the Directional Movement System, which includes:

+DI (Positive Directional Indicator)

–DI (Negative Directional Indicator)

ADX (the smoothed average of the difference between +DI and –DI)

✅ Key ADX Levels:

0–20: No trend / Weak trend

20–40: Stronger trend forming

40–60: Strong trend

60+: Very strong trend (often near exhaustion)

Note: ADX doesn’t show direction, only strength. You must combine it with +DI/–DI or price structure.

🤖 Why Use AI with ADX?

While the ADX is powerful, it struggles in fast-changing, noisy markets. AI complements it by:

Filtering false signals

Adapting indicator periods to volatility

Learning from historical trend behaviors

Combining ADX with other real-time data for confluence

💡 Benefits of Combining ADX and AI:

| Feature | Traditional ADX | AI-Enhanced ADX |

|---|---|---|

| Static period (14) | ✅ | ❌ |

| Adaptive to market shifts | ❌ | ✅ |

| Noise filtering | ❌ | ✅ |

| Trend forecasting | ❌ | ✅ |

| Multivariate context (volume, news, price action) | ❌ | ✅ |

🔬 How AI Enhances the Use of ADX

🔹 1. Dynamic ADX Period Adjustment

The standard 14-period ADX isn’t always suitable across assets or timeframes. AI models can:

Shorten or extend periods based on volatility

Tune parameters to asset behavior (e.g., crypto vs. forex)

This leads to more accurate trend strength readings.

🔹 2. Pattern Recognition with ADX

AI analyzes millions of past chart patterns and identifies how:

ADX behaved before strong trends

False breakouts occurred despite rising ADX

Volume and price action aligned or diverged from ADX signals

The result? A pattern-informed ADX signal, not a standalone line.

🔹 3. Machine Learning Filters

AI uses ML models like:

LSTM (Long Short-Term Memory) for time-sequenced trend data

Random Forests to combine ADX with 10+ other indicators

Reinforcement Learning to learn when ADX signals work best

AI can flag trend strength with confidence scores like:

“Current ADX value = 32 → 82% probability of sustained bullish trend based on past 300 cases”

🔹 4. Multi-Timeframe ADX Confluence

AI synchronizes ADX values across:

1H, 4H, Daily, Weekly

Detects alignment vs. divergence

Marks optimal entry points when multiple timeframes agree

This helps reduce false entries and improves confidence in longer-term trends.

📈 Real-World Use Cases of ADX and AI

| Use Case | AI Enhancement |

|---|---|

| Forex Trend Trading | AI adjusts ADX period per currency pair volatility |

| Crypto Volatility | AI smooths ADX to reduce noise from wild swings |

| Swing Trading | AI identifies trend continuation patterns using ADX slopes |

| Breakout Confirmation | AI confirms with ADX + volume + price structure |

| Reversal Timing | AI detects ADX peaking → likely exhaustion signal |

🛠️ Best Tools for ADX with AI Integration

| Platform | Features | Free? |

|---|---|---|

| TrendSpider | Dynamic ADX overlays with AI trend detection | ❌ (trial only) |

| TradingView (AI scripts) | Pine Script bots that read ADX signals with ML | ✅ |

| MetaTrader + AI EAs | Expert Advisors using ADX + AI filters | ✅ |

| QuantConnect / Backtrader | Build custom AI models with ADX | ✅ |

| TensorTrade / FinRL | Use deep RL to optimize trading rules with ADX | ✅ |

📊 Example: ADX and AI in a Bullish Setup

Scenario: Trading NASDAQ on 1H timeframe

ADX starts rising above 25

Price breaks recent resistance

AI confirms:

Rising volume

MACD bullish crossover

Similar patterns had 70% success rate in backtest

✅ AI-Driven Signal: Bullish trend confirmed, enter long with tight stop

❌ Without AI, the trader might ignore volume or get faked out

🎯 How ADX with AI Improves Entry & Exit Timing

Entry:

Wait for ADX to rise above 20–25

AI checks confluence from:

Volume surge

Price structure

Sentiment/NLP data

Past data patterns

Exit:

AI monitors ADX flattening or declining

Alerts you when momentum fades

Suggests trailing stop adjustments

🧠 Smart ADX-Based Trading Logic with AI

AI models can even recommend strategies:

Range-bound if ADX < 20

Trend-following if ADX > 30

Scalping if ADX is neutral but news-driven

⚖️ Traditional ADX vs AI-Enhanced ADX

| Feature | Classic ADX | AI-Based ADX |

|---|---|---|

| Lagging indicator | ✅ | ❌ (predictive models) |

| Works alone | ❌ | ✅ (multi-signal integration) |

| Custom per asset | ❌ | ✅ |

| Emotional bias | ✅ | ❌ |

| Learning from mistakes | ❌ | ✅ (self-improving) |

🔮 Future of ADX and AI

In the next few years, expect:

AI models that adapt ADX parameters live based on data

Real-time NLP + ADX fusion (news drives trend strength)

AI dashboards offering “trend confidence scores”

AI-powered bots that only enter when ADX + 3 other signals align

You’ll no longer need to interpret ADX manually—AI will analyze, learn, and trade for you.

❓ FAQs

❓ Can I use AI with ADX without coding?

Yes! Platforms like TrendSpider, TradingView, and MetaTrader offer pre-built AI scripts and bots.

❓ Is AI good for identifying false trends?

Absolutely. AI compares current data with historical patterns to flag fakeouts, weak trends, or chop zones.

❓ Can I build my own AI model using ADX?

Yes. Use Python + libraries like Scikit-learn, Backtrader, TensorFlow to create custom models.

🔗 Related Reads You Might Like:

Pingback: Parabolic SAR with AI: Smarter Trailing Stop-Loss and Trend Management - Trade Pluse Ai