Discover the anatomy of an AI generated stock report in this detailed guide. Learn how free AI tools analyze, format, and deliver powerful insights for investors.

In today’s data-driven financial world, stock market insights are no longer exclusive to elite analysts or institutional investors. Thanks to artificial intelligence (AI), individual traders and beginner investors now have access to detailed stock reports generated in seconds—many of them completely free.

But what exactly goes into these reports? What makes them different from traditional analysis? This guide breaks down the anatomy of an AI generated stock report (free version) to help you understand what to expect, how to use the information, and what limitations to keep in mind.

Let’s decode the AI-driven report and discover how free tools can transform your investment decision-making.

💡 Why AI-Generated Stock Reports Matter

Traditional stock reports involve hours of manual research and interpretation. They often require financial literacy and access to premium databases. An AI generated stock report, however, leverages:

Machine Learning for trend prediction

Natural Language Processing (NLP) to analyze news and sentiment

Real-time Data Processing for current metrics

These reports provide fast, consistent insights, making them perfect for both beginners and time-constrained investors.

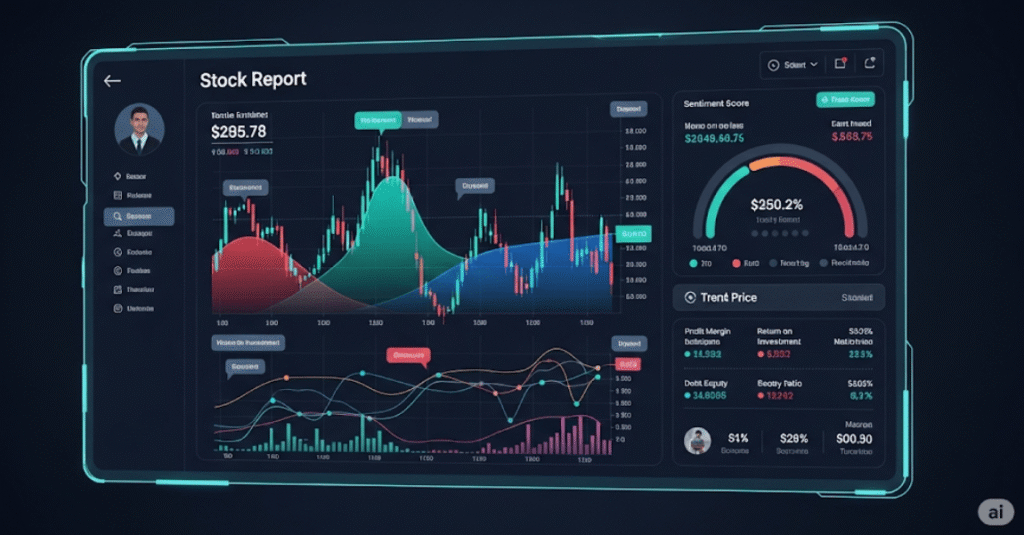

🧠 Core Components of an AI-Generated Stock Report

Let’s break down the essential elements you’ll find in most free AI generated stock reports.

1. 🪪 Stock Overview and Identity

The first section offers a snapshot of the stock:

Ticker Symbol & Exchange

Company Name & Sector

Market Capitalization (Large-Cap, Mid-Cap, etc.)

Current Price and Change (Daily/Weekly)

✅ Purpose: Gives users an immediate identity check before diving deeper.

2. 📉 Price History & Trend Visualization

AI reports often generate visualizations of:

Historical Price Charts (1D, 1W, 1M, 1Y)

Trendlines (Support/Resistance)

Price Volatility Indicators

AI models use past data to draw projected movement lines or even simulate short-term forecasts based on regression or time-series models.

✅ Purpose: Shows momentum and entry/exit zones.

3. 📊 Technical Indicators and AI Signals

AI generated reports commonly include automated analysis of:

Relative Strength Index (RSI)

MACD (Moving Average Convergence Divergence)

Simple/Exponential Moving Averages (SMA/EMA)

AI Buy/Sell Signals

These indicators are powered by machine learning models trained to spot key market behavior.

✅ Purpose: Helps traders identify trends and reversals without manually crunching indicators.

4. 📰 News Sentiment Analysis

This section is where NLP comes into play. AI scours headlines, financial news, and press releases to assign:

Sentiment Score (Positive/Neutral/Negative)

Trending Keywords

Volume of Mentions

Some reports even break this down into sentiment over time—showing if the stock has been gaining favor or falling under scrutiny.

✅ Purpose: Combines qualitative media input with quantitative signals.

5. 📈 Predictive Modeling: AI Forecasts

One of the most valuable parts of an AI generated stock report (free version) is the forecast section:

Short-Term Price Prediction (1–5 Days)

Medium-Term Projection (1–4 Weeks)

Confidence Score (%)

These predictions are usually powered by models like LSTM, neural networks, or support vector machines, depending on the provider.

✅ Purpose: Offers probability-based expectations to guide decisions—not guarantees.

6. 💵 Fundamental Analysis (Simplified)

Some free AI tools scrape basic financial ratios, including:

Price-to-Earnings (P/E)

Debt-to-Equity (D/E)

Earnings Per Share (EPS)

Dividend Yield

This is a condensed version of deep fundamental research and may be limited depending on data access.

✅ Purpose: Gives a quick scan of the company’s financial health.

7. 📌 Peer Comparisons & Sector Ranking

AI tools often analyze similar companies and compare the stock’s performance and metrics against:

Sector Peers

Market Leaders

Benchmark Indices

Visuals like radar charts or heat maps are used to rank stocks on performance, valuation, or risk.

✅ Purpose: Contextualizes the stock within its ecosystem.

8. 📋 Risk Analysis

AI-generated risk sections might include:

Beta Value (Market Volatility)

Drawdown Scenarios

Backtest Performance

News-based Risk Factors

Some tools also generate a “Risk Rating” on a scale of 1–5 or Low–High.

✅ Purpose: Helps manage expectations and capital allocation.

9. 🤖 Model Transparency (If Available)

Some AI tools give you a breakdown of how the report was built:

Type of Model Used (e.g., Decision Tree, LSTM)

Dataset Sources (e.g., Yahoo Finance, Quandl, news APIs)

Training Period or Limitations

This is rare in free versions but valuable when included.

✅ Purpose: Builds trust and allows for better user judgment.

📱 Top Free Platforms Offering AI Generated Stock Reports

FinBrain.tech – Sentiment and pattern analysis with charts

Tickeron – Pattern-based AI signals and predictions

Ziggma – Stock scores and analysis dashboards

TipRanks (Free Version) – Analyst AI-based consensus

Simply Wall St (Free Plan) – Visual, fundamentals-heavy reports

All of these platforms simplify the anatomy of an AI generated stock report for free or with limited use tiers.

🛠️ How to Read and Use an AI Stock Report (Free Version)

✅ Do:

Compare signals with other research

Use sentiment + trends together

Monitor predictive confidence

Use peer comparison for confirmation

❌ Don’t:

Trade solely on AI-generated signals

Ignore broader macroeconomic news

Assume high prediction = guaranteed outcome

Use these tools as assistants, not decision-makers.

⚠️ Limitations of Free AI Stock Reports

While powerful, the free version of AI-generated stock reports does have constraints:

| Limitation | Explanation |

|---|---|

| Data Access | Often limited to public sources |

| Forecast Timeframes | Typically short-term only |

| Model Complexity | Simpler algorithms than paid tiers |

| Personalization | Less tailored to your portfolio |

| Depth of Financials | Lacks full financial statement data |

These limitations don’t make them useless—just incomplete for high-stakes decisions.

🧩 Integrating AI Reports Into Your Workflow

Start with one report per stock you’re analyzing. Use it to:

Screen ideas quickly

Validate technical levels

Gauge public sentiment

Flag red flags automatically

Pair this with your own risk appetite and strategy. Over time, you’ll learn how to judge when the AI gets it right—and when to double-check.

🧠 Final Thoughts: A New Era of Smart, Accessible Analysis

Understanding the anatomy of an AI generated stock report (free version) allows you to unlock actionable insights without being an expert. While premium tools offer deeper dives, free reports are often sufficient for getting ahead of the average retail investor.

The key is to not treat these reports as a crystal ball—but as a valuable second opinion powered by fast, scalable, and unbiased computation.

Pingback: 5 Key Limits: Understanding AI’s Limitations in Bear vs. Bull Markets - Trade Pluse Ai