📘 Exploring Different AI Models for Stock Prediction (Simplified)

Exploring different AI models for stock prediction in this simplified guide. Learn how machine learning and deep learning tools forecast stock trends for smarter investing.

In the fast-moving world of stock trading, artificial intelligence (AI) is changing the game. From hedge funds to individual traders, many now rely on AI-powered tools to forecast market trends. This article aims to help beginners by exploring different AI models for stock prediction in a simple, digestible way.

We’ll break down what each model does, how it works, and where it shines. Whether you’re new to stock investing or just curious about AI, this guide will give you the insight you need to make smarter decisions with the help of modern technology.

🤖 What Does “AI for Stock Prediction” Really Mean?

Before exploring different AI models for stock prediction, let’s clarify what “AI” means in this context. AI involves using algorithms that can:

Analyze historical price patterns

Detect investor sentiment from news or social media

Predict future price movements based on real-time data

These AI models don’t guarantee profits—but they do provide data-driven insights that are difficult to achieve manually.

🧠 Why Use AI for Stock Prediction?

Traditional stock analysis methods rely on human interpretation of charts, financial reports, and market news. AI automates and enhances this process by:

Processing huge datasets rapidly

Identifying subtle patterns and correlations

Learning from mistakes and improving predictions

Now, let’s begin exploring different AI models for stock prediction and see how each contributes uniquely.

🔍 1. Linear Regression: The Basic Predictor

🔹 How It Works:

Linear regression is the simplest model, using historical data to draw a line that best fits a trend. It assumes that future price changes will follow a linear pattern.

🔹 Pros:

Easy to understand and implement

Great for trend-based predictions

🔹 Cons:

Oversimplifies market behavior

Poor at handling volatility or sudden changes

📌 Best used for: Long-term stock trends with minimal noise.

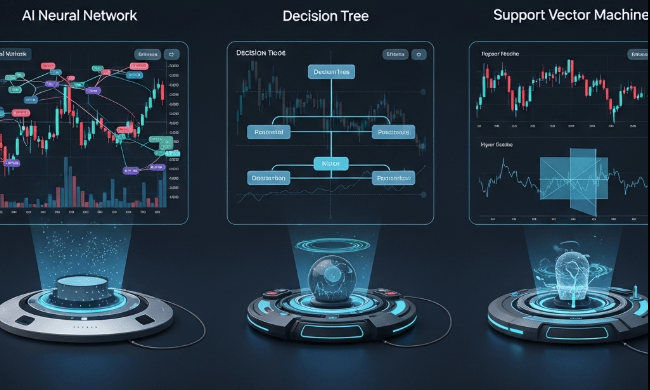

🌳 2. Decision Trees and Random Forests

🔹 How They Work:

Decision trees split data based on rules like “If the price rose today, then…”. Random forests combine multiple decision trees for more accuracy.

🔹 Pros:

Easy to visualize and interpret

Handles both numeric and categorical data

🔹 Cons:

Can overfit to training data

Less effective with real-time streaming data

📌 Best used for: Screening stocks based on technical or fundamental indicators.

🧮 3. Support Vector Machines (SVM)

🔹 How It Works:

SVMs classify data into groups by finding the best boundary that separates them. For stocks, they predict whether a stock will go up or down.

🔹 Pros:

High accuracy with small datasets

Strong at binary classification

🔹 Cons:

Computationally heavy

Harder to scale with large, real-time datasets

📌 Best used for: Predicting short-term price direction or earnings surprise.

🧠 4. Neural Networks and Deep Learning

🔹 How They Work:

Neural networks mimic the human brain with layers of “neurons” processing data. Deep learning refers to networks with multiple layers for complex problem solving.

🔹 Pros:

Exceptional at recognizing nonlinear patterns

Can learn from unstructured data (e.g., news)

🔹 Cons:

Requires massive computing power

Harder to interpret the “why” behind predictions

📌 Best used for: High-frequency trading, price prediction, and market sentiment analysis.

⏱️ 5. Recurrent Neural Networks (RNN) and LSTM

🔹 How They Work:

RNNs and LSTMs (Long Short-Term Memory networks) are designed to handle sequences—perfect for stock time series data.

🔹 Pros:

Remembers past price trends

Great for multi-step forecasting

🔹 Cons:

Needs a lot of data

Slower training time

📌 Best used for: Predicting stock prices over days, weeks, or months.

📊 6. K-Nearest Neighbors (KNN)

🔹 How It Works:

KNN compares a stock’s current features with past stocks and finds the most similar ones to predict the next move.

🔹 Pros:

Simple and intuitive

No training time required

🔹 Cons:

Slower with large datasets

Not ideal for volatile markets

📌 Best used for: Clustering similar stocks or anomaly detection.

🧪 7. Reinforcement Learning (RL)

🔹 How It Works:

RL models “learn” by trial and error. They get rewarded for making the right move, similar to training a robot.

🔹 Pros:

Adapts to changing environments

Useful for automated trading bots

🔹 Cons:

Complex and time-consuming

Risky if improperly trained

📌 Best used for: Automated portfolio management and algorithmic trading.

🧰 Which AI Model Is Best?

That depends on your goal:

| Goal | Recommended Model |

|---|---|

| Long-term trend prediction | Linear Regression or LSTM |

| Technical screening | Decision Trees / Random Forests |

| Directional calls | SVM or Neural Networks |

| High-frequency trading | Deep Learning / Reinforcement Learning |

When exploring different AI models for stock prediction, it’s crucial to match the model with the problem you’re solving.

📱 Free Tools That Use These AI Models

Many platforms let you test or access these models for free:

Yahoo Finance (via Python APIs) – For data and linear modeling

FinBrain – Neural networks for prediction

Tickeron – Pattern-based AI with visual backtesting

Alpaca.ai – Offers a Python-based trading bot framework

QuantConnect – Backtest models including SVM, LSTM, RL

Google Colab – Try coding your own models for free

🧩 Integrating AI Into Your Investment Routine

Even if you’re not a coder, you can still benefit from AI tools by:

Using pre-built stock screeners with AI filters

Reading sentiment-based analysis from AI news bots

Subscribing to platforms that offer prediction dashboards

Watching patterns AI tools identify, then confirming with your research

Exploring different AI models for stock prediction doesn’t require a data science degree—it just takes curiosity and consistency.

⚠️ Limitations of AI in Stock Prediction

While promising, AI isn’t magic. Watch out for:

Overfitting: When a model works well on past data but fails in real time

Black Box Models: Complex models you can’t interpret

Data Bias: If bad data goes in, bad predictions come out

Market Anomalies: No model can predict sudden geopolitical shifts or crises

Always test models before using them in real trades.

🧠 Final Thoughts: AI is Your Assistant, Not Your Fortune Teller

Exploring different AI models for stock prediction opens the door to smarter, faster, and more informed investing. But no model is perfect. The key is to combine AI insights with human intuition, risk management, and research.

Don’t fall for hype. Use AI to reduce guesswork, not replace decision-making.

Pingback: Unlocking Insights: The Anatomy of an AI Generated Stock Report (Free Version) in 2025 - Trade Pluse Ai